- Trading volumes should pick up as summer ends

- Domestic equity markets decline for second week in a row

- Macro backdrop remains favorable for equities

- Concern over market pullback increases

- Trading volumes should pick up as summer ends

- Domestic equity markets decline for second week in a row

- Macro backdrop remains favorable for equities

- Concern over market pullback increases

The dog days of summer are waning as we move towards Labor Day which typically signals the return of higher trading volumes in the domestic equity markets. More importantly, second quarter earnings season is virtually complete and the Federal Open Market Committee doesn’t meet again until October removing two major fundamental factors from the markets temporarily. Thus far the negativity and political chatter out of Washington has had negligible impact on the domestic markets which have grinded higher (both stocks and bonds) since the election late last year - perhaps this dynamic changes.

All three major domestic equity benchmarks fell for the second week in a row. This week the decline was less pronounced with markets declining well under 1%. Earnings releases were mixed and numerous financial media articles pointed out that for companies that reported earnings above consensus expectations the underlying stock price movement was less positive than what is historically normal. Consequently, the drawn conclusion is that investors expectations are extremely high and the domestic equity rally is long in tooth.

The backdrop for domestic capital markets continue to be a net positive with earnings growth being the major catalyst. The effort to tighten monetary policy by the Fed continues to be hampered by the lack of inflation and mediocre economic growth. In addition, repressed interest rates globally have acted to retard increases in rates domestically. Late to the current environment has been the pick up in growth internationally and the decline in the value of the dollar both of which are positive catalysts for domestic markets. Energy markets continue to be relatively unpredictable as oil prices seek equilibrium. Geo politics are always a wildcard for markets but generally negative as the situation with North Korea the last few weeks has highlighted.

Client inquiries and the financial press continue to worry about a pullback in the domestic equity markets. We provided some perspective last week, and will look next week at S&P 500 market returns since 1980 but more importantly intra year declines in the S&P 500. Suffice it to say that pullbacks are a natural part of the capital market cycle, inevitable, healthy, and virtually unpredictable. Stay tuned.

On the economic front July new-home sales are released Wednesday; existing home sales are released Thursday, and durable goods orders are released Friday.

Earnings releases next week are once again dominated by retailers:

Monday – Dycom and Nordson

Tuesday – Toll Brothers, DSW, Medtronic, and Salesforce.com

Wednesday – American Eagle Outfitters, Eaton Vance, Guess, HP, and Lowe’s

Thursday – Abercrombie & Fitch, J. M. Smucker, Michaels, Signet Jewelers, and Tiffany

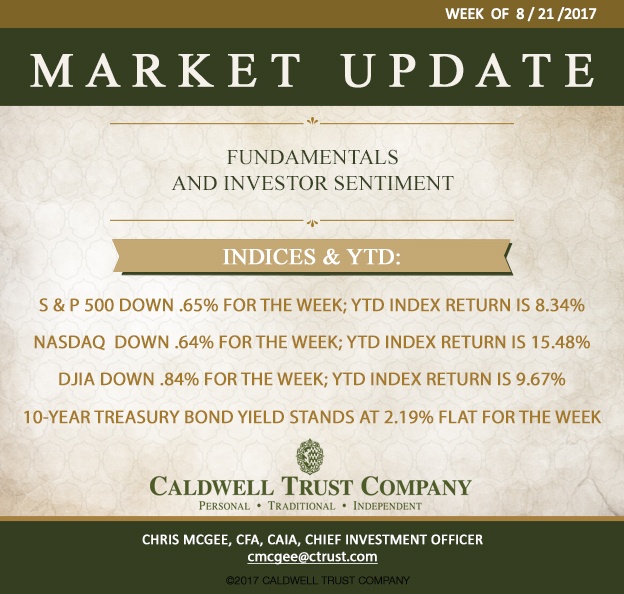

Indices for the week and YTD are as follows:

S & P 500 down .65% for the week; YTD index return is 8.34%

NASDAQ Composite down .64% for the week; YTD index return is 15.48%

Dow Jones Industrial Average down .84% for the week; YTD index return is 9.67%

Benchmark 10-year Treasury bond yield stands at 2.19% flat for the week.

------------------------------------------------------------------------------------------------------------------------------------------------------Chris McGee heads Caldwell’s investment committee, which draws on a team of experienced in-house professionals and carefully chosen outside analysts to make decisions for client portfolios.

A Chartered Financial Analyst (CFA) and Chartered Alternative Investment Analyst (CAIA), McGee had previously been senior investment adviser and senior vice president at PNC Wealth Management in Sarasota for nearly a decade. Prior to that he was portfolio manager for five years with U.S. Trust (formerly Bank of America) in Sarasota. Before relocating here, he had served as vice president, capital management, for Wachovia Bank in Winston-Salem, North Carolina.

----------------------------------------------------------------------------------------------------------------------------------------------------

About Caldwell Trust Company

Caldwell Trust Company is an independent trust company with offices in Venice and Sarasota, Florida. Established in 1993, the firm currently has nearly $1 billion dollars in assets under management for clients throughout the United States. The company offers a full range of fiduciary services to individuals including services as trustee, custodian, investment adviser, financial manager and personal representative. Additionally, Caldwell manages 401(k) and 403(b) qualified retirement plans for employers.