Your Market Update:

- The Dow moves higher; S&P 500 and NASDAQ retreat

- Q2 earnings growth continues to be strong in aggregate

- S&P 500 valuation high but not excessive

- Initial Q2 GDP growth in line

- The Fed doesn't increase the Fed Funds rate

Last week was a bit of an exception in the domestic equity markets as the “FANG” stocks declined on a net basis and a few old-line industrials moved higher. Consequently, both the S&P 500 and the NASDAQ Composite were down slightly for the week, and the Dow Jones Industrials advanced more than 1%. Both the S&P 500 and the Dow Jones Industrials have now returned in the double digits year-to-date. The worst performing sectors on the year – Telecommunications and Energy were the best performers for the week.

Nearly 60% of S&P 500 companies have reported Q2 earnings and 73% have beaten both earnings and revenue estimates; this is slightly above average based on history. Earnings growth is running in the high single digits for Q2 - pretty much as expected. The Energy sector has reported the largest growth as the sector continues to recover from the collapse of oil prices two years ago.

Much press has been given to the run up in equity markets and the length of this bull market in stocks (8+ years). Ultimately, valuations are criticized for being stretched. Per FactSet the forward P/E on the S&P stands at 17.7X. The 5 and 10-year averages are 15.4X and 10.4X respectively (keep in mind the 10-year P/E includes the subprime crisis). Given the trajectory of earnings growth and the persistent low interest rate environment we would argue that while the current valuation on the S&P 500 is indeed high, it isn’t excessive. The caveat is that earnings growth continues to come through; to date it has.

Q2 GDP was released last week and came in at an annualized rate of 2.6% which is in line with the Q2 results for the last number of years, as was the final Q1 GDP growth rate of 1.2%. Inflation continues to run at lower levels than hoped for by the Federal Reserve.

As anticipated the Federal Reserve did not increase the Fed Funds rate at last week’s meeting. They did signal that reduction in their balance sheet is currently scheduled to commence in the fall. As mentioned previously, the consensus “Street” probability of a rate hike in December continues to decline and stands below 40%.

On the economic front, the Chicago Purchasing Managers Index for July is released Monday. Personal income and the ISM Manufacturing Index are out Tuesday. July non-farm payrolls is released Friday; the consensus estimate stands at an increase of about 200,000.

Earnings reports for next week are many and dominated by the Energy sector as noted below.:

Monday – Diamond Offshore, Loews, and Pandora Media

Tuesday – HealthSouth, Sprint, Apple, and Under Armour

Wednesday – Devon Energy, EOG Resources, and Newfield Exploration

Thursday – Ball, Chesapeake Energy, GrubHub, and Williams

Friday – Post Holdings, and Southwestern Energy

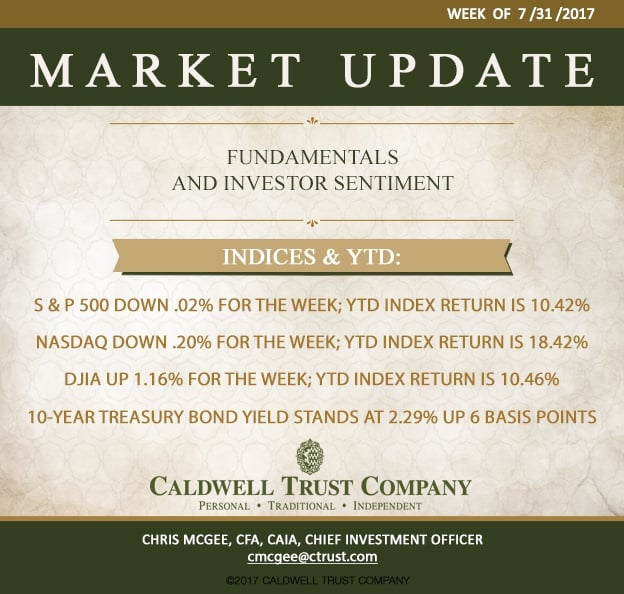

Indices for the week and YTD are as follows:

S & P 500 down .02% for the week; YTD index return is 10.42%

NASDAQ Composite down .20% for the week; YTD index return is 18.42%

Dow Jones Industrial Average up 1.16% for the week; YTD index return is 10.46%

Benchmark 10-year Treasury bond yield stands at 2.29% up 6 basis points for the week.

Chris McGee heads Caldwell’s investment committee, which draws on a team of experienced in-house professionals and carefully chosen outside analysts to make decisions for client portfolios.

A Chartered Financial Analyst (CFA) and Chartered Alternative Investment Analyst (CAIA), McGee had previously been senior investment adviser and senior vice president at PNC Wealth Management in Sarasota for nearly a decade. Prior to that he was portfolio manager for five years with U.S. Trust (formerly Bank of America) in Sarasota. Before relocating here, he had served as vice president, capital management, for Wachovia Bank in Winston-Salem, North Carolina.

----------------------------------------------------------------------------------------------------------------------------------------------------

About Caldwell Trust Company

Caldwell Trust Company is an independent trust company with offices in Venice and Sarasota, Florida. Established in 1993, the firm currently has nearly $1 billion dollars in assets under management for clients throughout the United States. The company offers a full range of fiduciary services to individuals including services as trustee, custodian, investment adviser, financial manager and personal representative. Additionally, Caldwell manages 401(k) and 403(b) qualified retirement plans for employers.