- Earnings reports continue to roll in

- Earnings growth over next 18-24 months long strong

- Equity market valuations not extreme

- Rally in domestic stocks continue

- Earnings reports and Fed to fominate next week's news flow

Approximately a quarter of S&P 500 companies have reported Q4 2017 earnings thus far. Earnings results are running in line with historic norms (76% of companies are beating consensus estimates), and quarterly revenues are running above trend. This coming week many high-profile companies across diverse industry groups report. Thursday is chock full of earnings results from Technology companies; Friday is dominated with reports from big Energy concerns.

We focus so much on earnings because corporate profits ultimately drive stock prices. We are currently in the midst of accelerating earnings growth and this is a large factor in the current bull market in stocks. To put things in perspective, 2017 will be the first year of meaningful earnings growth in four with S&P 500 earnings per share projected to come in at around $132 per share, up from $119 in 2016. Earnings are now forecast to come in at approximately $153 this year, and we are currently seeing forecasts of approximately $165 and $185 per share for 2019 and 2020 respectively. This puts the current forward P/E multiple on the S&P 500 at 18.7X, 17.2X, and 15.5X for 2018, 2019, and 2020 respectively. Obviously, long dated forecasts are fraught with peril but based on what is forecasted currently the broad domestic equity market is not extremely overvalued.

For the week equity markets domestically were up over 2% as the rally continues. As we move into the last three trading sessions of January the markets have already advanced in the high single digits and market fundamentals continue to improve. Bond yields held for the week with little change. The Federal Reserve meets next week, and no short-term rate increase is anticipated though three rate hikes have been signaled by the Fed for 2018.

President Trump gives the State of the Union Address Tuesday. Per Barron’s he is anticipated to unveil an infrastructure initiative. While his address may impact markets next week the preponderance of economic releases and earnings reports should dominate market action.

On the economic calendar next week, the Case-Shiller indices of home prices is released Tuesday. The Federal Open Market Committee (FOMC) meets Tuesday and Wednesday. The ISM manufacturing index for January is released Thursday. Factory orders for December are released by the Census Bureau on Friday.

Next week continues the onslaught of Q4 earnings reports:

Monday – Lockheed Martin, Seagate Technology, and Dominion Energy

Tuesday – Pfizer, McDonald’s, Harley Davidson, Corning, and Danaher

Wednesday – Mondelez, AT&T, Boeing, Microsoft, and Facebook

Thursday – Alphabet (aka Google), Alibaba, Amazon, and Apple

Friday – Exxon Mobil, Chevron, and Philips 66

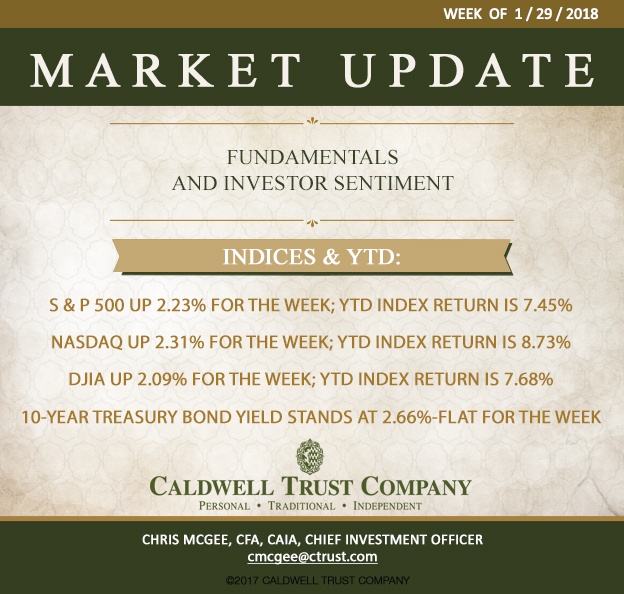

Indices for the week and YTD are as follows:

S & P 500 up 2.23% for the week; YTD index return is 7.45%

NASDAQ Composite up 2.31% for the week; YTD index return is 8.73%

Dow Jones Industrial Average up 2.09% for the week; YTD index return is 7.68%

Benchmark 10-year Treasury bond yield stands at 2.66% - flat for the week

About Caldwell Trust Company

Caldwell Trust Company is an independent trust company with offices in Venice and Sarasota, Florida. Established in 1993, the firm currently has nearly $1 billion dollars in assets under management for clients throughout the United States. The company offers a full range of fiduciary services to individuals including services as trustee, custodian, investment adviser, financial manager and personal representative. Additionally, Caldwell manages 401(k) and 403(b) qualified retirement plans for employers.